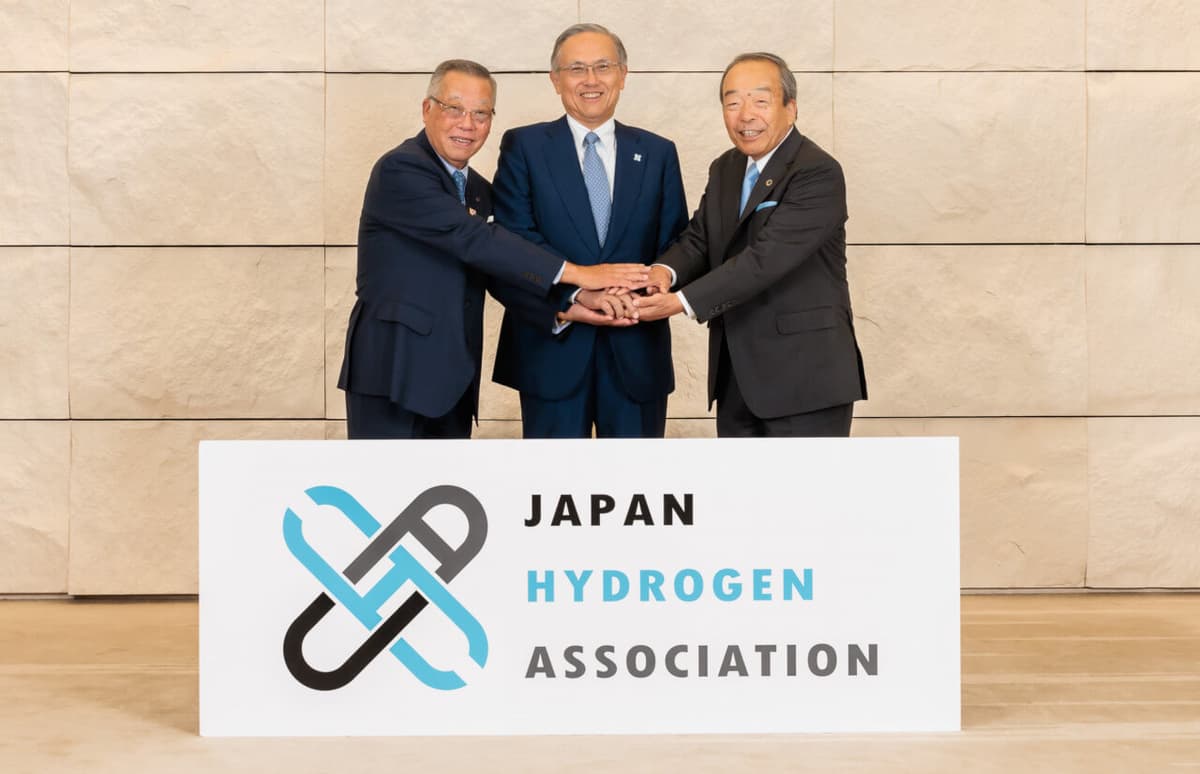

The first Japan Hydrogen Fund has been launched with over $400m committed by Japanese industrial and financing majors, along with TotalEnergies.

Managed by equity firm, Advantaged Partners (AP) and headed up by the Japan Hydrogen Association (JH2A), the fund is “dedicated to developing the low-carbon hydrogen value chain.”

Seeing participation from Toyota, Iwatani, Sumitomo Mitsui Banking, MUFG Bank, Tokyo Century, Japan Green Investment Corp. for Carbon Neutrality and the Bank of Fukoka, the fund will invest in hydrogen production, storage, transportation and use facilities.

It comes after JH2A and AP agreed to set up the fund in September last year to focus on creating demand for hydrogen, reducing costs and providing funds to business involved in value chains “around the world.”

“The establishment of this fund has been a long-cherished wish of JH2A since its establishment.

In addition to the promotion of hydrogen projects by private companies and regions and policy support…we hope to contribute to the support of the social implementation of hydrogen through the supply of funds…and contribute to the realisation of a hydrogen society,” said JH2A Secretary General, Hiroshi Fukushima.

It comes just months after Japan passed the Hydrogen Society Promotion Act, with a 15-year subsidy for Japanese-produced and imported low-carbon hydrogen.

Read more:Japan passes act promising 15-year low-carbon hydrogen subsidy

Get up to speed on hydrogen with Class of H2

At a time when hydrogen is the new gold rush for so many investors and start-ups alike, and the skills gap risks becoming the skills gulf, H2 View’s Class of H2 presents a series of hydrogen training modules.

Our first masterclass is created to bring your hydrogen fundamentals up-to-speed, covering the basics, e-fuels and ammonia, low-carbon and green hydrogen production, turquoise hydrogen production, biomass pathways, and underground hydrogen storage.

To book your on-demand training session, click here. Or you can reach out to the Class of H2 team at +44 1872 225031 or [email protected].