Market accessibility problems for German applicants

When the European Hydrogen Bank’s first pilot auction (Innovation Fund Auction IF23) was announced on Sept. 5, 2023, it drew much attention. April 30, 2024, then saw the publication of the results for the pilot auction, for which the European Union was making EUR 800 million of support available. Seven projects from northern and southern Europe were successful in obtaining funding. The aim of the hydrogen auction is to accelerate the rollout of green hydrogen and send price signals by narrowing the cost gap between green and fossil-based hydrogen.

The EU’s funding offer was met with particular interest by German hydrogen producers at a time when hydrogen funding in Germany has been greatly reduced due to the ruling by Germany’s constitutional court on the country’s climate and transformation fund. The average bid for German projects was around 108 percent above the average price bid for the seven successful European projects. As part of the pilot auction, Germany also provided an extra EUR 350 million to be channeled exclusively into German projects. German bidders are therefore eagerly awaiting the outcome of the auction for German funding. Another funding call is planned for the end of 2024.

Funding environment for electrolysis in Germany

Over the past few years, Germany has offered extensive funding programs for hydrogen projects, especially in the mobility area. The second phase of Germany’s national hydrogen and fuel cell innovation program (NIP 2) played a key role in supporting the research, development and rollout of hydrogen and fuel cell technologies. It focused particularly on raising technology readiness and competitiveness in the transportation sector. Major projects, such as those promoting fuel cell vehicles and hydrogen refueling stations, received financial support which was then significantly scaled back following the decision by the constitutional court on the climate and transformation fund.

Parallel to this, the HyLand scheme has provided funding for the development and implementation of hydrogen technologies in various regions of Germany. In its initial phase it helped 25 regions establish a hydrogen economy. These were then joined by 15 HyStarter and 15 HyExpert regions in the second phase.

Positive developments in the funding environment were also seen at a European level. The Clean Hydrogen Partnership, successor of the Fuel Cell and Hydrogen Joint Undertaking (FCH JU) under Horizon 2020, awarded nine Hydrogen Valleys with a total of EUR 105.4 million, thereby subsidizing the production of at least 13,500 metric tons of green hydrogen a year.

Another important mechanism has been the Important Projects of Common European Interest or IPCEIs in the area of hydrogen. This program backs innovative and strategically significant key technologies along the entire value chain, from production through application in industry and mobility. In Germany, 62 large-scale projects have been selected to receive over EUR 8 billion in funds from German central or regional government.

These developments illustrate a trend whereby Germany has drastically decreased its funding due to the budgetary crisis while the European Union has increased its financing of hydrogen technologies. This is why the Innovation Fund Auction 23 was greatly anticipated by many potential hydrogen producers in Germany.

The Innovation Fund Auction (IFA)

The Innovation Fund Auction (IF Auction) is a funding mechanism which is part of the European Innovation Fund. The Innovation Fund is the biggest funding pot for decarbonizing the EU and will supply a total of around EUR 40 billion in assistance between 2020 and 2030. The money is sourced from the revenue generated by the European Union Emissions Trading System or EU ETS. To stimulate hydrogen rollout in the European Union, the EU Commission launched the European Hydrogen Bank, known as the EHB, in 2022 as part of the Innovation Fund. This financing instrument is designed to target and support the establishment of hydrogen supply and demand. Dedicated funding for the production of renewable hydrogen within the EU is provided through the Innovation Fund Auction,

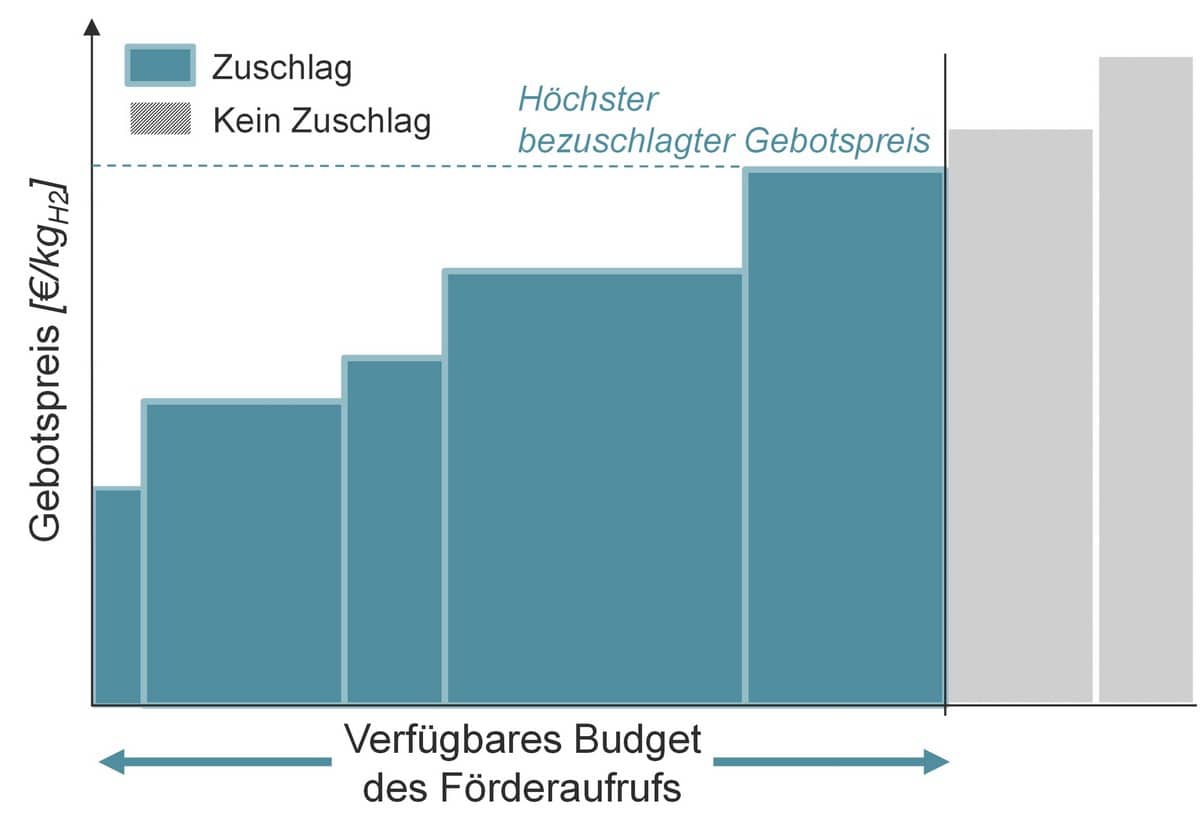

which works by subsidizing each kilogram of hydrogen produced (EUR/kgH2). This sets the funding mechanism apart from most other European and German funding arrangements which largely provide grants toward the capital outlay on electrolyzers, with operating costs ineligible for support (e.g., under NIP 2).

The cost subsidy equates to the bid price which potential funding recipients have to submit as part of the allocation procedure for their projects. So as to rank individual funding amounts, participants were made aware that the maximum possible bid price in the first funding call for the IF23 Auction (November 2023 to February 2024) would be capped at 4.50 EUR/kgH2 – any bids above this ceiling were to be excluded.

The funding amount sought by each bidder is calculated from the bid price per kilogram of hydrogen multiplied by the quantity of hydrogen that is planned to be produced over the project’s lifetime (usually 10 years). Funding is allocated via an auction in which the lowest bid prices – similar to the merit order principle – are awarded funding until the available budget for the particular funding calls has been exceeded (see fig. 1).

The available budget in the first round of the funding call was EUR 800 million. In addition, EU member states were free to introduce extra funds to support further projects in their own countries. For instance, Germany supplemented the initial funding call with an additional sum of EUR 350 million which could be awarded to the best-placed German projects that had been overlooked.

The terms of participation for bidders are complex and can vary from one funding call to another. One key condition is that only hydrogen manufactured according to European requirements for the production of renewable fuels of non-biological origin (RFNBOs) is eligible. An added condition for participation in the first tendering round was a minimum electrolyzer capacity for the bidder of 5 megawatts.

Pilot auction results

The first auction for the EUR 800 million in EU funding concluded at the end of April 2024. In all, EUR 720 million was awarded to seven projects for the production of renewable hydrogen (see fig. 2). The winning bids ranged from EUR 0.37 to EUR 0.48 per kilogram of hydrogen. The weighted average bid was EUR 0.45 per kilogram of hydrogen.

Fig. 2: Overview of funded projects

What is notable is that all successful projects are situated on the Iberian Peninsula and in Scandinavian countries. One of the primary reasons for this is the availability of cheap renewable electricity in those locations (solar power in Spain and Portugal and hydropower in Scandinavia).

The bids put forward by German projects were priced much higher than the successful bids. A rough analysis of the bid summary produced a weighted average bid of around EUR 1.53 per kilogram of hydrogen for the German proposals. This is 108 percent higher than the weighted average of the successful bids. There were also German projects that submitted bids of around EUR 0.60 per kilogram of hydrogen. Perhaps an indication that in Germany, too, certain off-takers are prepared to pay a premium for green hydrogen. The majority of German applications, however, needed a subsidy of between EUR 1.20 and EUR 3.87 per kilogram of hydrogen.

The high bid prices from Germany can be largely explained by looking at example production costs (see fig. 3). With production costs of EUR 8.50 per kilogram of hydrogen, the average successful bid price would result in a cost reduction of only around 5 percent. An important factor in the cost of production is the proportional cost of electricity, accounting for approximately half the cost of producing 1 kilogram of hydrogen, which is due to the high energy prices in Germany.

Fig. 3: Example hydrogen production costs for electrolysis in Germany

Still outstanding are the results for the auction for the EUR 350 million that Germany is awarding to the best-placed, overlooked German projects. The results of this auction and details of which German proposals have been successful will likely yield further fascinating insights into the ramp-up of the hydrogen economy in Germany.

Outlook

The next tendering round (IF24 Auction) is expected to follow at the close of 2024. It is advisable for interested parties to prepare their application documents in good time since initial stakeholder talks between the EU and potential applicants began back in June 2024 and the complexity of the application process is not to be underestimated.

The EU has already published initial information on the configuration of the funding scheme, or rather the adjustments to it. A significant change is the lowering of the maximum acceptable bid price from 4.50 to 3.50 EUR/kgH2. For this second funding call, German projects will need to develop strategies that will enable them to enter the auction with lower bids. Should Germany again provide additional resources for homegrown projects for the next funding call, this would create further opportunities. Consequently, there is a great deal of intrigue surrounding the forthcoming announcement of which German projects will receive backing from the German funding pot.

Authors: Nikolas Beneke, Shaun Pick, both from BBH Consulting AG