37th BImSchV enables extra revenue for renewable fuels

Germany’s greenhouse gas reduction quota (GHG quota) is a climate policy tool which is designed to cut the country’s transport emissions and encourage the use of renewable energy in the mobility sector. It implements the provisions of the European Union’s Renewable Energy Directive in German law and aims to meet the minimum renewables share required in the transport sector for 2030 and beyond.

The high GHG emissions from transportation are attributable to the use of fossil fuels. This is the reason why petroleum companies, or rather fossil fuel distributors, are obliged to compensate for a certain percentage of their emissions and to invest in lower-emission alternatives. This percentage is termed the GHG reduction quota and is set at a minimum of 9.25 percent for the year 2024. The level will then be raised continually, reaching 25 percent in 2030.

To meet these targets, the German Federal Immission Control Act (BImSchG) allows certain fulfillment options, such as biofuels, charging current or electrolytic hydrogen, to earn credit through quota trading, thus making it possible to generate attractive amounts of additional revenue. Companies which are subject to quotas pay distributors of renewable fuels for the emissions savings, enabling them to meet their targets and thereby avoiding a penalty of EUR 600 per metric ton of CO2. The 37th Ordinance on the Implementation of the Federal Immission Control Act (37th BImSchV), in particular, regulates renewable fuels of non-biological origin or RFNBOs while the 38th BImSchV, for example, governs charging current.

Renewable fuels of non-biological origin

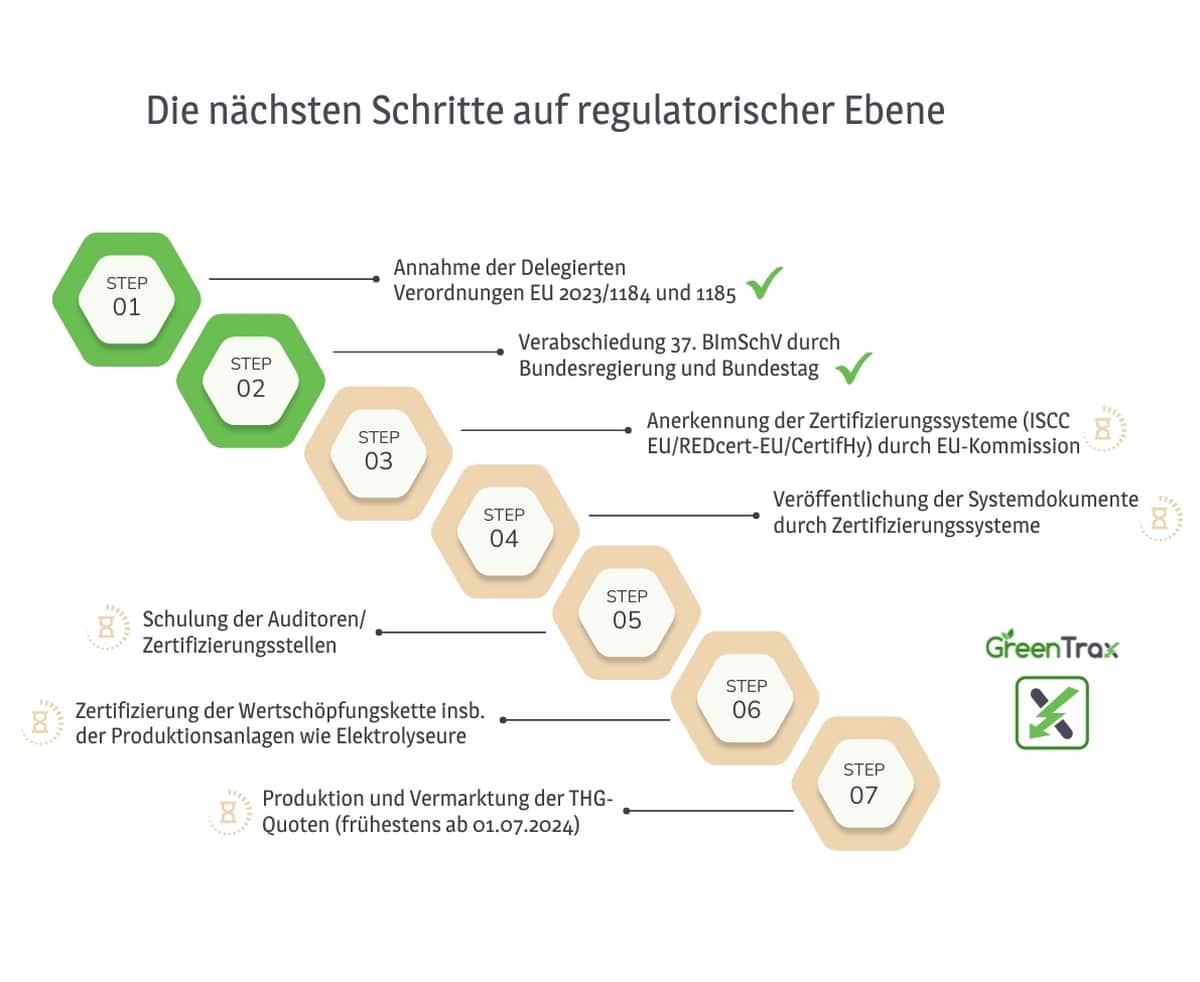

In March 2024, the German parliament passed an amendment to the 37th BImSchV which covers RFNBOs. It makes a wide spectrum of different electrolytic fuels eligible under the GHG quota, including green hydrogen. Nevertheless, the new ordinance only affects fuels that are brought into circulation from July 1, 2024.

The provisions mostly apply to the production of RFNBOs and hence directly to producers. However, the companies that are eligible for the quota and entitled to earn revenue under the scheme are not the producers but the RFNBO distributors, which are generally the operators of RFNBO refueling stations. Furthermore, the use of RFNBOs in the refinery is also possible. In this case, the refinery itself is considered a distributor and is therefore eligible under the quota scheme.

Fundamentally, for green hydrogen and RFNBOs to count for the GHG quota, the power purchasing criteria need to be met as set out in the Delegated Regulation EU 2023/1184, in addition to a minimum GHG saving of 70 percent, calculated according to the provisions in the second Delegated Regulation EU 2023/1185. To provide evidence of this, production plants, including potential suppliers, have to be certified in a certification system recognized by the European Commission (e.g., REDcert EU or ISCC EU).

Only once certification has been obtained can the produced RFNBO be counted – provided the minimum saving of 70 percent is met. These rules apply as part of the German GHG quota for RFNBOs as used in the transport sector, but also set standards for RFNBOs as used in other EU states and in other end-use sectors (but without the possibility of earning quota revenue).

Once RFNBO certification systems have been recognized by the European Commission, the relevant market participants can seek certification. Prior to this, it is not possible to produce RFNBO and use it for the GHG quota. Pre-certifications are, however, possible and can speed up the certification process in certain circumstances but they are not legally valid in relation to the 37th BImSchV and also do not provide for retrospective recognition of renewable fuels that have been produced.

Partially renewable fuel

The power purchasing criteria from EU 2023/1184 are replicated exactly in national law and can therefore likewise be found in the 37th BImSchV. A distinction needs to be made between fully and partially renewable fuel. Fully renewable fuel must generally meet all power purchasing criteria (see fig. 2), including the conclusion of a green power purchase agreement (green PPA), in other words a contract for the supply and purchasing of renewable electricity, for example between the operator of a wind farm and the operator of an electrolyzer. Partially renewable fuel is not required to meet these criteria. Thus the first stage is to check whether the fuel meets the full RFNBO classification under the ordinance.

An electrolyzer could, for example, purchase mains electricity and have to redeem only the electricity guarantees of origin in line with the average renewables share without fulfilling the other power purchasing criteria (whereby no biomass-based guarantee of origin is permitted to be used). In such cases, the average renewables share of the electricity consumed in Germany, known as RES-E, would be referenced two years before the year of production. If the renewables share were, for instance, 50 percent, a maximum of 50 percent of the fuel produced in this way would be recognized as RFNBO.

In practice, however, production via this kind of power purchasing alone is not possible in Germany since the relatively high emissions factor for mains electricity is taken into consideration and this usually means the minimum saving of 70 percent is not met. The assignment of total emissions to products such as heat and oxygen that have been recovered from the production plant could provide a remedy, like proportional production together with production from fully renewable fuel via the use of a green PPA.

Emissions can be assigned in the case of the electrochemical production of hydrogen, heat and oxygen, for example, using the economic value of the products. However, if all products have an energy value, emissions must be assigned according to the energy content. This improves hydrogen’s GHG footprint.

Fig. 2: Overview of current regulations

Fully renewable fuel

Alongside partially renewable fuel, the production of fully renewable fuel is also possible. For a fuel to qualify as fully renewable, the criteria need to be met as set out in fig. 2 according to the particular power purchasing scenario, whereby 100 percent of the fuel produced can be counted as RFNBO. If a proportion of the production uses electricity that does not meet these requirements, the result would be proportionally less than 100 percent (depending on the renewables share in the power grid at the particular production site).

Example

An electrolyzer purchases 70 percent of its electricity via a green PPA (Scenario 2 from fig. 2) and 30 percent on the spot market, including the redemption of electricity guarantees of origin. If the renewables share in the grid is 50 percent, then this would mean a maximum of 70 percent plus 15 percent, in other words 85 percent RFNBO; the remaining 15 percent could be marketed as low-carbon hydrogen but cannot be used for the GHG quota. Whether 85 percent is actually classed as RFNBO, will only be decided if it is clear whether the minimum saving of 70 percent is met for the overall amount.

The method for calculating this minimum saving and the GHG intensities of various RFNBOs is presented in the second delegated regulation and its annex (EU 2023/1185). It therefore also determines the starting value for emissions savings that can be marketed within the framework of the German GHG reduction quota. Here, the 37th BImSchV refers directly to the delegated regulation.

More clarity on revenue potential

As a basic principle, all emissions throughout a specific fuel’s life cycle need to be recorded (well-to-wheel analysis). This includes the emissions from feedstock (raw materials, auxiliary materials and consumables) as well as, for instance, electricity, treated water, nitrogen or electrolyte, such as potassium hydroxide, the emissions resulting from production (e.g., leaks or waste treatment) and emissions caused by transportation via diesel tractor units and distribution at the refueling station. In comparison with fuels for combustion vehicles, no additional GHG emissions occur during use. In the case of hydrogen, however, emissions quickly build to a critical level during transportation and distribution since the diesel trucks used for carrying hydrogen cannot currently be replaced with sustainable forms of propulsion for legal reasons and the refueling stations generally are not permitted to use a green PPA, meaning the power consumed for compression and cooling has to be set off against a correspondingly poor emissions factor. As it stands, there are not yet standardized emission values, e.g., for compression and cooling at refueling stations or for production via electrolyzers with low capacities (roughly < 5 MWel).

Requirements for feedstock emissions

In the case of hydrogen or RFNBOs classified as fully renewable, the electricity used for production is given an emission factor of 0 kg CO2/GJ. However, there are also requirements for hydrogen that is only partially renewable. Here, use is made of the average GHG intensity of mains power for the particular EU member state in which the hydrogen production plant is situated. Yet since all RFNBOs have to demonstrate a GHG saving of at least 70 percent compared with the fossil-fuel reference, it is currently possible to qualify with relatively poor mains electricity values only under certain conditions, for instance the assignment of emissions to any commercially used byproducts such as heat and oxygen or proportional production in compliance with power purchasing criteria (via a green PPA). In addition to electricity, all other feedstocks need to be incorporated into the emissions calculation. The expertise of specialist consultants can be called upon for drawing up certifiable calculation methods and carrying out an assessment of the sustainability criteria.

The GHG intensity for the RFNBO (feedstock, production, transportation and distribution) is permitted to be a maximum of 28.2 kg CO2/GJ, after taking into account the minimum saving, in order to qualify for the GHG quota. Quota trading requires that the “last interface” issues proof of sustainability for the relevant RFNBO quantities produced and transferred to suppliers. Only the last interface is entitled to issue this proof. Normally this is the producer which manufactures the fuel to the quality required for use in transport.

This proof of sustainability contains, among other things, the confirmation that all power purchasing criteria and GHG requirements have been met. It also details the GHG intensity of the RFNBO which has been calculated for the particular designated use. For this, the last interface again uses the GHG intensities of possible upstream interfaces and adds to these its own emissions, including downstream transportation and distribution.

Proof of sustainability can only be issued if there is a valid certificate for the production site which has been supplied by one of the certification systems recognized by the European Commission. Proof of sustainability and certificates must also be set up for verification purposes in the Union Database for RFNBOs and in the register of the relevant authority of the German Environment Agency. Both registers are currently under construction.

Fig. 3: From GHG intensity to GHG reduction quantity

This production-specific GHG intensity of the RFNBO can then be used as a basis for calculating the GHG reduction quantity for the GHG quota. Fig. 3 above assumes a GHG value of 20 kg CO2/GJ H2, which would work out at a reduction quantity of almost 28 kg CO2 per kg H2 (incl. triple accounting).

This reduction quantity falls over time, however. If the GHG reduction quota increases over time – as foreseen by legislators – the reduction figure would decrease as a result of green hydrogen since even this type of hydrogen has to meet the reduction quota. Additional revenue from green hydrogen can be deduced depending on the achievable market prices per metric ton of CO2: For example, if the market price is EUR 130 per ton of CO2 (no cap quota), this can generate additional revenue of around EUR 3.60 per kg H2 in 2024.

For quota revenue to be paid, in general the quota transfer needs to have taken place previously through the relevant biofuel quota center at the main customs office. Here, specialist quota service providers can take care of quota trading, supply quota trading agreements and provide support to ensure formal requirements and application deadlines are met. In addition, trading models with an index price or fixed price for RFNBOs can be set if requested (including over several years), thus ensuring secure and predictable quota revenue.

Author: David Benjamin Pflegler, GT Emission Solutions GmbH, Kleve, Germany