The figures for fiscal 2022, but above all an evaluation of the written version of the accompanying conference call with expert analysts from renowned investment banks, suggest a very good future for Bloom Energy and support my extremely optimistic assessment. In it were many self-commendations from the board: “Bloom is now a predictable-growth company. Bloom is ideally positioned in many markets, is developing new complementary technologies, is entering new business fields and is building up and expanding its international engagements (also now strengthening Europe to South Korea link). Quote: “In 2022, we demonstrated record-breaking efficiencies for hydrogen production using our electrolyzers…and our highly promising carbon capture technology.”

My summary: The first stage in establishing the new factory in Fremont, California has been started – Bloom has invested 200 million USD and is producing stacks for the Energy Servers as well as the electrolyzers. Production capacity is still to double within this fiscal year. Federal subsidies from the Inflation Reduction Act (IRA) will surely be used for this. With a 10 billion USD order volume (plus of 1.5 billion USD), the company is on a good path. They address a diversity of markets that primarily supply clean energy and create energy security 24/7.

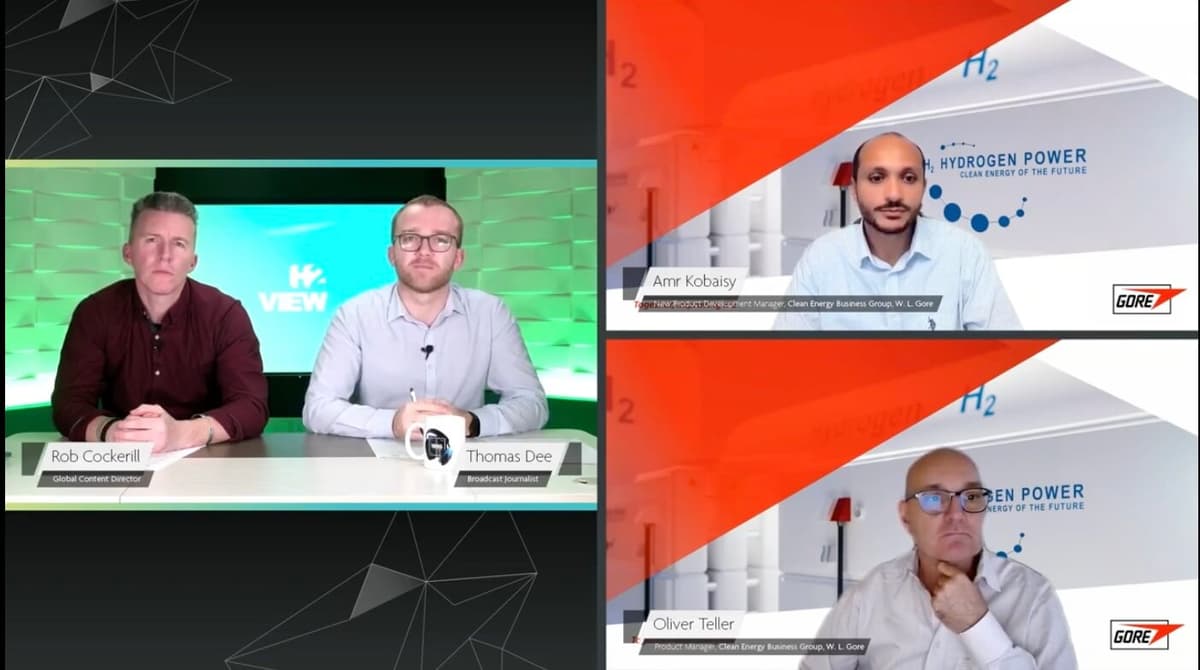

A 200-kW microgrid solution from Bloom

Softbank Japan 5710 200kW Microgrid (1).jpg

Source: Bloom

Example: Optimizations such as a power-and-heat approach allow waste heat to be sensibly used. This was not really done in the USA up to now – it has been in Europe. Process and district heating are finding their use and increasing the efficiency of the Energy Servers and FC power plants to a record-breaking 90 percent. Biogas as a basis for hydrogen, relying on waste-to-hydrogen technologies, will also be a very big future topic for Bloom. In addition, the US company is working on carbon capture technologies to reduce CO2 emissions or make e-fuels. With all these topics, Bloom intends to focus in particular on the markets and regions of the world where the highest profit margins can be generated.

It would be conceivable to set up production facilities for the Servers/stacks in Europe at a later point in time, when the domestic demand allows for this and the production capacities in the USA are fully utilized. Should the EU define its own IRA-like program such that producers in Europe must produce for Europe, this could of course incentivize Bloom to establish production in Europe (supply chains). But right now that’s a far-off dream.

Profit margin is expandable

The figures for 2022: Nearly 1.2 billion USD turnover, and a fourth quarter with record sales of 462.8 million USD (at 400 million USD expectation). From the quarter in the previous year, a heavy plus of 41.4{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8}. Although the profit margin according to the non-US GAAP calculation was over 30{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} in the fourth quarter (23{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} for the whole year), it was with GAAP accounting however only 15.4{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} in Q4. Non-GAAP profit here reached 59 million USD – although the operating loss amounted to 40.6 million USD.

The order volume is record-breaking: 10 billion USD (8.5 billion USD in previous year). It should be noted here that the GAAP result also factors in bonus programs for employees and managers (stock option plans, stock compensation), which distorts the result. Meanwhile, non-GAAP accounting is considered even more informative than accounting via GAAP. Because with the former, one-time factors like extraordinary depreciations (non-recurring losses) and stock compensation plans are taken out of the equation.

Bloom therefore earned – before extraordinary expenses – non-GAAP: 0.27 USD per share. The profit margin is set to increase step by step to 30{7bfcd0aebedba9ec56d5615176ab7cebc5409dfb82345290162ba6c44abf8bc8} if these one-time factors turn out to be smaller in the calculation when the next years are included.

Cash and cash equivalents at the end of the last financial year amounted to 500 million USD, and it will shortly (first quarter) rise by another 313 million USD, as the SK Group/SK Ecoplant plans to send the second tranche for its stake in Bloom.

Analysts are divided but positive

The one side of analysts is evaluating the situation as it is (current quarterly figures, profit margins); the other, the prospects according to the existing fundamentals and corporate forecasts. It could therefore be heard that analyst Mark Strouse at J.P. Morgan has lowered the share price potential after the publication of the fourth-quarter figures with a price target of 29 to 27 USD. His rating: from outperform to neutral.

Strouse sees profit margins as not yet at the level forecast by the company itself, while his colleague at Morgan Stanley in turn raised his rating to Outperform. His price target for the share: 35 USD. Bloom is very well positioned in all important areas of its market and has a high sustainable growth potential.

In other words: The one sees a half-empty glass and the other, a half-full one. Important to me are, above all, the prospects and not a single quarter’s indication or a single fiscal year. All must be considered.

Critical considerations

The share price rose on the day of the publication of the figures to nearly ten percent intraday, but then fell again in the following days. This is owed to, in my view, the opinion of some market participants and analysts that the profit margin does not yet meet the targets and forecasts. Furthermore, the high order volume must be taken into perspective, as it includes long-term service contracts totaling 7.2 to 10 billion USD.

The area of electrolysis, against expectations, will not be able to generate really noteworthy revenue before year 2024. There were already high expectations for this for 2023. The high amount of short interest, expressed in the shares sold short, must also not be overlooked, as short sellers have no interest in increasing prices and will maintain influence over the price development via trading (basis for increased price fluctuations). Good news (orders placed, technological breakthroughs) is the basis for potentially rising prices and particularly for the returns (profit margins) from here.

The outlook is positive

Bloom is massively expanding production capacity for stacks for Energy Servers and electrolyzers. After doubling it for the Servers from 300 MW to 600 MW annually, the same will be done for the electrolyzers. Production is running behind demand for the FC power plants (Energy Servers), suggesting a strong long-term growth. The transition to the profit zone (sustained and strongly increasing) we think will appear starting 2024, as that is when the electrolyzers from the newly established capacities will also come to market. Bloom could then also itself become an H2 producer and profit from IRA subsidies of 3 USD per kg H2.

Through constant optimization and through the leveraging of cost reduction potentials (scaling), this development at Bloom will have an impact on earnings in a positive sense. Bloom is expecting 40 percent of turnover in the first half of 2023 and 60 percent in the second half (approval process-related influences). Turnover in the running fiscal year is to lie at 1.4 to 1.5 billion USD, which corresponds to a growth of 17 to 25 percent and unfortunately not the more than 30 percent originally envisaged. But with this, one could also live well. In the medium to long term, however, growth is expected to reach 30 percent and more.

Looking at the whole picture with all the developments (global energy security and demand, hydrogen, climate issues, support programs like the IRA), Bloom is among the winners, which is reflected in the sharp rise in order intake and eventually also in reports of profit. New topics such as the use of SOFC Energy Servers in ships, carbon capture, power & heat, and waste-to-hydrogen are being technologically addressed by Bloom. From these, potential for new orders can be expected.

Important for the investment: time and patience. Temporarily weak share prices are suitable points to buy again. A, and my, key investment in the topic hydrogen and fuel cells. The reasons for great share expectations are manifold, so one can assume a good risk/reward ratio.

Disclaimer

Each investor must always be aware of their own risk when investing in shares and should consider a sensible risk diversification. The FC companies and shares mentioned here are small and mid cap, i.e. they are not standard stocks and their volatility is also much higher. This report is not meant to be viewed as purchase recommendations, and the author holds no liability for your actions. All information is based on publicly available sources and, as far as assessment is concerned, represents exclusively the personal opinion of the author, who focuses on medium- and long-term valuation and not on short-term profit. The author may be in possession of the shares presented here.

Written by author Sven Jösting, March 5th, 2023