H2 View’s first conference and exhibition in Asia-Pacific rounded off with the popular ‘Make Hydrogen Happen’ panel which saw three leading figures debate the challenges and opportunities facing the region’s hydrogen development.

On the panel were Connie Lo, Principal Consultant at NexantECA, the international consulting firm which advises national oil companies, financial and government institutions; Marcoen Stoop, Business Development Director Asia at Nel Hydrogen; and Dr. Hacib Benaissa, Product Development Manager at Lynas Rare Earths.

Stoop set the scene by saying green hydrogen requires green electricity – its affordability and affordability – so that’s the first factor to consider when scouting for hydrogen projects. Lo agreed and immediately highlighted Australia’s abundant resources potential before turning to China.

“It’s producing about 33 million tonnes of hydrogen a year – it’s almost half the capacity of producers in the world,” she said. “China has also produced its renewable energy plans as it strives to decarbonise its economy. Under the government’s plans, it wants to have as much as 200,000 tonnes per year of hydrogen, and targeting 55,000 vehicles running on hydrogen by 2025.”

Alongside China’s production status, a key regional dynamic is the plethora of countries which Lo listed as ‘demand’ centres, such as Singapore, Korea, South Korea, Japan and India.

“There are so many areas in mobility and power where hydrogen sits. As I mentioned at the Asia-Pacific Industrial Gases Conference, why can’t we pick the ‘low-hanging fruits’ with industries and refineries that are currently consuming hydrogen today? They have all the existing infrastructure, the pipelines and storage, so while we’re in this transitional phase, we should be looking at these industries.”

Dr. Hacib said one major hindrance currently for hydrogen is storage and transport infrastructure isn’t wholly in place. “The value chain across the world is not connected,” he said. “All the technologies and requirements aren’t really working very closely together. I think there’ll be a lot of cracks along the way – I don’t think things will collapse, but I expect delays.”

Stoop said another key element is the production-consumption dynamic. “It will be very important to decide – what is the best way to transport hydrogen,” he said. “Countries such as Japan and Korea simply don’t have enough renewable energy in their countries.”

Lo said a lot of issues come back to the high cost of green hydrogen production. “Over 60% of the cost of production lies with renewable energy so first of all you have to work out how to bring about cheaper energy, and secondly, how you integrate it. Then aside from the cost of production, if you want to export it, there’s no economical way to do it on a large scale. If you’re using ammonia as a hydrogen carrier, then you’ll have to crack it at the port – that’s another area that’s not been resolved, and the ships for transporting liquid hydrogen don’t exist.”

Stoop spoke about the relationship between industrial and policy development. “If we draw a line, and see where we started and where we should be, we’re so far behind. So let’s try and catch up.”

Lo added, “How do you address the issue of encouraging a favourable business investment, for demand as well as the producers? Countries in this region can look at the US, the IRA and production tax credits, to bridge the gap between the high costs of production and lower marketing pricing. Australia has its Hydrogen Headstart programme, Korea has the contract-for-difference approach and giving incentives, but in order to kick start the hydrogen economy in this region, governments need to look into this.”

She turned to Sustainable Aviation Fuels (SAF), which is rising in popularity but will likely take years to scale. “Airlines are under pressure to decarbonise and you can see in Europe, there is policy to reduce carbon footprint. There will be an opportunity but there’s a long way to go.”

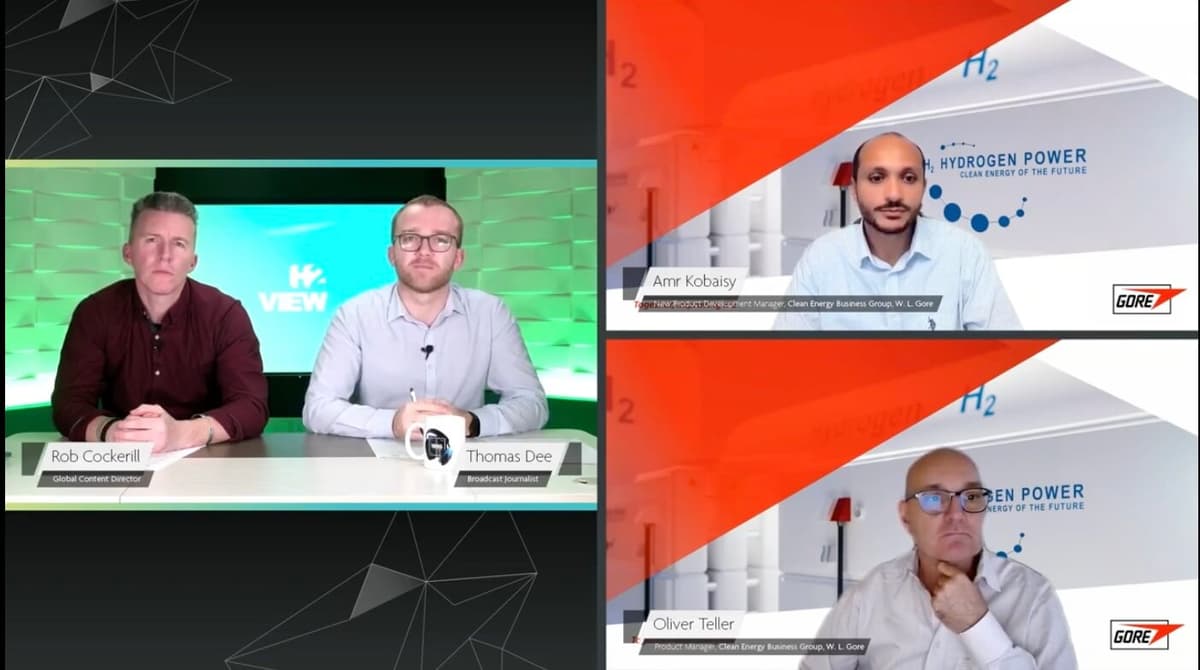

Closing the session, Content Director Rob Cockerill, moderating, asked the panel if they felt hydrogen is being ‘hijacked’ amid clear signs that leading companies and governments are supporting increased fossil fuel production. “Basically strategies are in place to buy people time,” said Dr. Hacib. “We shouldn’t kid ourselves about the scale of the task ahead – it isn’t a walk in the park. Industries established over decades aren’t going to go away overnight, it’s a new industrial revolution.”

Lo said, “Even though we might be getting pushback from the oil and gas industry, there’s no other solution at the moment. Unless scientists come up with novel ways to create alternative energy, we still have to work with the business route. We must continue to focus on the industry, developing harmonisation and standards, if you’re going to develop cross-border trade.”

Stoop said, “If we want to get to these targets, we have to start now, and sort out the financing. All we can do is our best, in the electrolyser industry, to make it as reliable and affordable as possible. We have seen the industry go from 1MW to 5MW, and now we’re looking at 200MW, so we have grown, we are on the right track. But we need more positive final investment decisions.”